Getting personal with biometrics for security

Tim Compston, Guest Features Writer at Security News Desk, has his finger on the pulse of the latest developments in biometrics. He speaks to Suprema, Genie, BioCatch, CEM Systems, Hitachi and more.

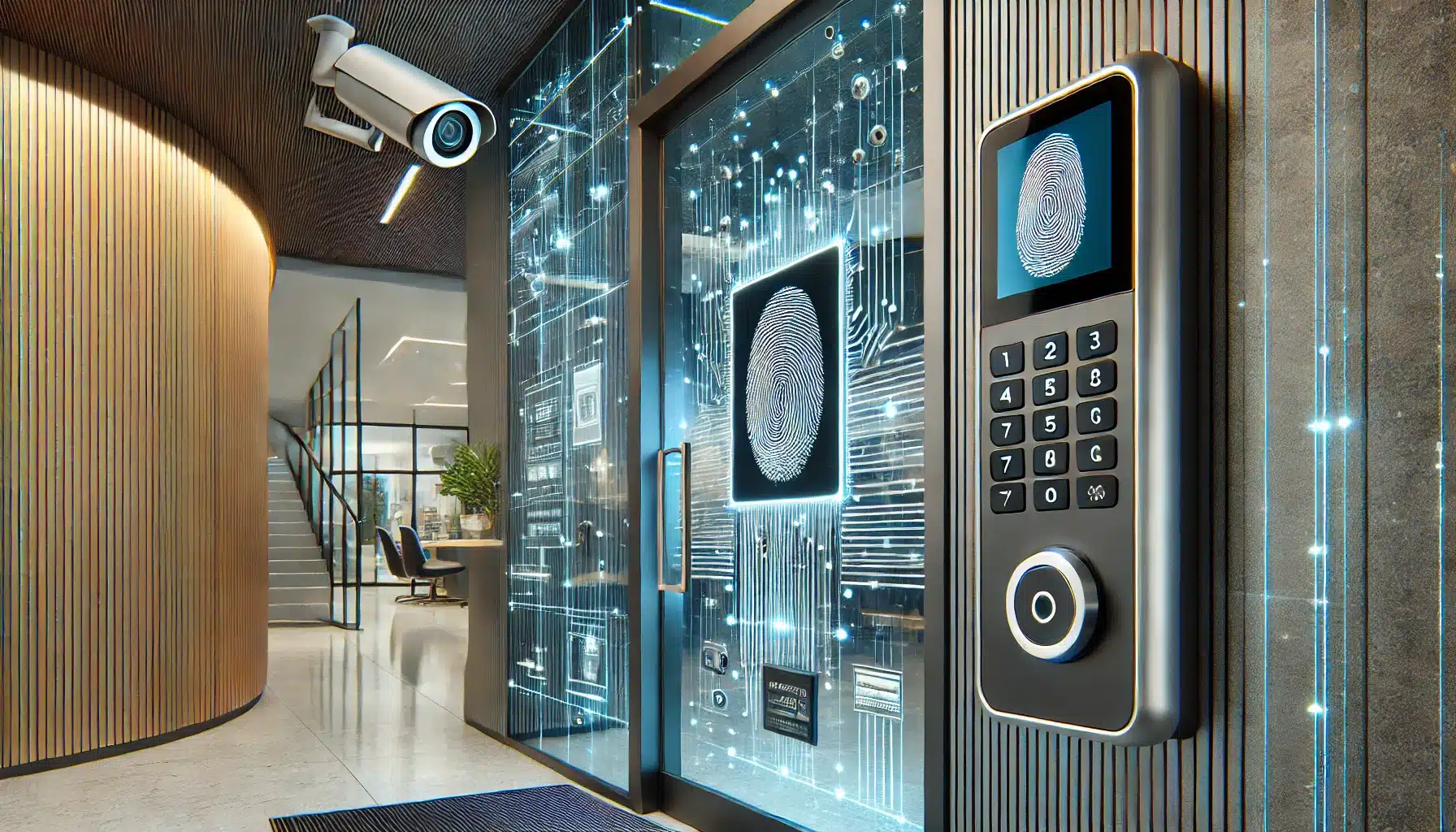

There is little doubt that biometrics, in all its guises, is gaining traction as a way of ramping up security and adding value for site management. Alongside this, many banks, on the back of heightened cybersecurity concerns, are keen to offer biometrics as an option for online and mobile banking to thwart fraudulent activity, which can result in problems for customers and reputational damage. Biometrics is also playing a pivotal role in border control with e-passports and visas becoming a common sight and, crucially, as a way – with facial recognition – to keep track of travellers within our major airports.

On the technology front we have certainly come a long way since the early days of fingerprint readers. Now we are seeing voice recognition, face or hand geometry, behavioural analytics, iris, palm and finger vein reading, all taking their place in the biometrics mix. The authentication route adopted for an application is, of course, dependent on factors including accuracy, ease of operation, and the cost of deployment. In the world of physical security, for instance, the biometric signature – ‘who you are’ – may be rolled out either by itself or as a multi-factor solution alongside a card – ‘what you have’- and a PIN – ‘what you know’. As the level of risk increases, not surprisingly, the desire to adopt some form of biometrics shows a corresponding upturn. If we take a data storage room as an example of a higher risk application then, in this type of scenario, the view of key vendors is that it really makes sense here to supplement a card with some form of biometric signature.

On the technology front we have certainly come a long way since the early days of fingerprint readers. Now we are seeing voice recognition, face or hand geometry, behavioural analytics, iris, palm and finger vein reading, all taking their place in the biometrics mix. The authentication route adopted for an application is, of course, dependent on factors including accuracy, ease of operation, and the cost of deployment. In the world of physical security, for instance, the biometric signature – ‘who you are’ – may be rolled out either by itself or as a multi-factor solution alongside a card – ‘what you have’- and a PIN – ‘what you know’. As the level of risk increases, not surprisingly, the desire to adopt some form of biometrics shows a corresponding upturn. If we take a data storage room as an example of a higher risk application then, in this type of scenario, the view of key vendors is that it really makes sense here to supplement a card with some form of biometric signature.

Market matters

So, what is the scale of the biometrics market today? To put some figures on the expanding footprint of biometrics, MarketsandMarkets, the market research firm, is forecasting in a report – ‘Biometric System Market by Authentication, Component, Function, Application and Region’ – that the biometric system market will be worth US $32.73 billion by 2022. This compares to $10.74 billion in 2015. To reach the 2022 level, MarketsandMarkets is anticipating a compounded annual growth rate (CAGR) of 16.79 per cent. In terms of the factors that are propelling this phenomenal level of growth, MarketsandMarkets suggests that much of the impetus for the heightened market demand is likely to come from the application of biometric technology in financial institutions, healthcare, government initiatives, and to identify criminals. Interestingly, despite all the hype around other approaches – based on 2015 figures – MarketsandMarkets reports that fingerprint recognition, one of the oldest and simplest techniques to install, still accounted for the largest market share for a single factor authentication segment.

Talking cybersecurity

Turning to cybersecurity, some experts reckon that the days of the old-fashioned password are well and truly numbered as biometrics builds up a head of steam. A recent survey by SecureAuth Corporation of IT decision makers in the UK indicated that nearly half of respondents – 49 per cent – felt that physical biometrics would be the main identity, and access method, employed by 2022. SecureAuth points out that this is a dramatic change from the previous year where only four per cent claimed they would be making such a move over the next five years. Commenting on the findings, James Romer, Regional Director – EMEA – at SecureAuth – reckons that for too long organisations have relied on passwords as a single form of access control: “It is simply not strong enough, nor adequate, to protect vital [IT] applications and data. The results clearly show that organisations have learnt from the [data breach] attacks of last year and are starting to come to terms with the fact that passwords aren’t the most secure method of verifying who someone is.”

Banking on biometrics

Looking at the banking sector, specifically, it is really going down the biometrics route in a big way. This is especially true when it comes to helping customers mitigate the risk of online fraud. A case in point was the announcement last year of a partnership between Daon and Gulf Bank Kuwait to provide biometric authentication within Gulf Bank Kuwait’s mobile banking application via Daon’s Identity Platform. César Gonzlez-Bueno, Gulf Bank’s Chief Executive Officer, says that by working with Daon the bank’s customers can now login with biometrics using their fingerprint touch ID and ‘Blinking to Bank’ facial recognition, from anywhere in the world, and perform a wide array of banking transactions efficiently and securely.

Tom Grissen, Daon’s Chief Executive Officer is also enthusiastic about the deal with Gulf Bank Kuwait, and the wider potential for biometrics across the banking world: “We are seeing tremendous opportunities for banks to leverage the power of biometrics to improve their customer experience. Convenient and secure authentication has become critical in today’s digital economy and we are very happy supporting Gulf Bank Kuwait on their journey to a mobile first, customer first strategy.” Grissen adds that the Identity Platform has been designed with an eye towards the future as it allows Daon’s customers to easily add new biometrics as they become commercially available.

Behavioural analysis

Another pertinent example of banks gravitating towards biometrics is, undoubtedly, the successful trial conducted by BioCatch – which specialises in behavioural biometrics – at NatWest Bank. The bank has been deploying the BioCatch technology since the start of 2016 within Coutts and for some of its business customers. Simon McNamara, Chief Administrative Officer at NatWest has been impressed with the breadth of behavioural biometrics that the BioCatch technology can monitor: “We’ve already seen many examples of it alerting us to suspicious activity and protecting our customers from fraud,” he says.

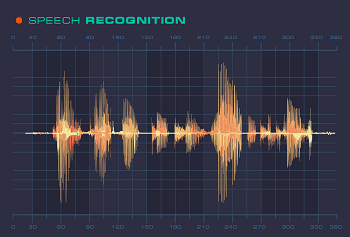

Making a noise

Interestingly, the volume of applications applying voice recognition for biometrics is also being turned up with banks ahead of the curve here too. It has been reported, for example, that HSBC is now deploying voice recognition and touch security services in the UK. The voice recognition element is being sourced from Nuance Communications and works by cross-checking over 100 unique identifiers including: behavioural features such as speed, cadence and pronunciation, and physical aspects including the shape of larynx, vocal tract and nasal passages. To use the service, HSBC’s customers enrol their voice print and no longer need to use passwords or PIN.

In the right vein

Keeping with the banking theme, other solutions which are now starting to pay dividends include finger vein and palm vein reading. For finger vein reading, Hitachi (Hitachi finger vein reader shown below) is the real pioneer and advocate of this technology which came out of medical research back in the 1990s. Essentially, it works by shining infrared light into the finger that reacts with the haemoglobin in the blood to create a visual blood pattern that can be imaged and, with an algorithm, a template is then created. The first commercial finger vein readers came on stream in Japan as far back as 2002 and appeared in Europe and the US in 2005/6.

So where does finger vein sit in the wider anatomy of biometric offerings? Well the experts say that it scores highly on accuracy and usability – similarly to the iris – but with a price point equivalent to a high-end fingerprint reader. The sectors being targeted by Hitachi for finger vein include: finance, telco and retail. Of these it is banking and finance where the greatest uptake has occurred, for example most ATMs in Japan use finger vein and it has been deployed in a similar way in Poland and Turkey. More recently, Hitachi has been working with Barclays Bank to provide the bank’s customers with a small desktop finger vein reader so they are able to log in through a portal and digitally sign transactions.

With regards to palm vein biometrics it is another Japanese vendor, Fujitsu, which is making the running with its PalmSecure sensors and has now produced a version which is only 8mm across making it compact enough for future tablets and other handheld mobile devices.

Fingerprint for Emerald

Despite a surge of interest in other biometric techniques many vendors are saying that there is still life left yet in the more traditional fingerprint. Asked about the rationale for the roll-out of a fingerprint version of Emerald – the multi-functional touch screen access control terminal – Philip Verner, Regional Sales Director, EMEA, for CEM Systems/Tyco Security Products, says that this move ties in with a wider industry trend to deploy biometrics more extensively. He adds that the latest Emerald model (TS300F) is targeted at locations where biometric verification is required to bring an added level of security for higher security areas by utilising multi-layered authentication of card and biometric: “It could, for example, be deployed outdoors at a gate [Emerald is IK06 and IP65 rated] or inside for the entrance to a server room.”

Charting a course for security at Harland and Wolff

In terms of the deployment of this biometrics version of the emerald access control terminal, CEM Systems announced back in September that it had won the contract to secure Harland and Wolff Heavy Industries sites in Belfast, Northern Ireland. G4S was selected as the integrator to install the AC2000 security solution throughout the Harland and Wolff sites. Part of the solution involved key high security areas, including the server room and equipment warehouse, being protected by Emerald TS300F fingerprint readers, requiring biometric verification for the entry of select authorized staff. In the equipment warehouse, emerald’s Checklist feature allows Harland and Wolff to prompt staff on exit to sign the register if they are removing any tools or equipment. This solution, says CEM, provides Harland and Wolff with valuable details of who accessed their warehouse, and is expected to help prevent the loss of valuable equipment and tools.

“Harland and Wolff is an iconic company in Northern Ireland with a rich history, and we are delighted to secure their vast site with AC2000 security management system and a range of CEM Systems access control readers, including Emerald. Going beyond security, CEM Systems is able to help Harland and Wolff become more operationally efficient, saving them both time and money and assisting them in ensuring the safety of all their staff and equipment,” says Verner.

On the subject of why fingerprint makes the most sense for Emerald, Verner responds that there is always a trade-off, with the various biometric technologies available, between reliability (in terms of ‘will it read right every time?’ or ‘will it give me a false reading?’), the economics, and ease-of-use: “Iris, for example, has always been more reliable than fingerprint but the downside is that there are less suppliers, it is more expensive, not as easy to use and often presents greater concerns to users,” he says. Ultimately, Verner suggests that fingerprint is still more heavily deployed because it is ‘tried and tested’ and becoming acceptable even in our daily lives thanks to biometrics on smart phones.

Government approval for Genie

For its part, Genie has announced that its flagship biometric fingerprint authentication system – VIRDI AC5000SC – will be included in CPNI’s trusted Catalogue of Security Equipment (CSE). “We are pleased to hear that the our widely popular fingerprint authentication system is now fully approved for UK government use. Our customers and their clients will clearly benefit from a trusted and proven biometric fingerprint system,” says John Boorman, Sales and Marketing Director, at Genie. Genie says that the AC5000 is an IP65 rated system which can detect “fake” fingerprints, is available in black and white housings, and features a customised LED display.

Going contactless with an extra dimension

One vendor that is bringing an added dimension to the future of biometrics is Swiss manufacturer TBS (Touchless Biometric Systems). This is in the shape of 3D touchless finger scanning technology which, the company claims, is more accurate and hygienic than a traditional fingerprint reader and is proving popular in areas like datacentres. With multiple sensors for 3D – rather than 2D – the TBS solution is designed to capture the highest possible quantity of fingerprint detail rather than, with 2D, simply a small central fingerprint. In fact, according to Philippe Niederhauser, Head of Sales and Marketing at TBS, 3D gathers about five times more information than 2D. He goes on to explain that, in practice, this greater detail means that the reader is in a much better position when people have ‘bad’ fingerprints or dust on their fingers. Other standout aspects of the proposition here, explains Niederhauser, includes hygiene as the reader is touchless.

Regarding recent rollouts of this technology, Niederhauser flags-up a new project for the Ministry of Sports Affairs in Oman, a Government Ministry that promotes the development of sport with 12 branches located throughout the country, and forges partnerships with local organisations. Niederhauser reports that the biggest drawback with the previous Time and Attendance system was having to pull out data manually from old touch-based fingerprint readers for over 800 users. Problems occurred not only because the process was time-consuming, but also because the old touch-based fingerprint readers simply produced too many identification failures from people with thin skin resulting from diabetes, high pigment skin, fingers decorated with henna, oil, or dust often could not be recognised. Niederhauser says that the TBS 3D technology wipes out these issues as it is equipped with capability to scan not just small and flat fingerprints but the larger finger surface in 3D.

Niederhauser adds that the TBS technology deployed here supports integration with remote locations so, ultimately, ensuring coverage in all the Ministry of Sports Affairs’ branches across Oman. In cooperation with TBS’ local Partner, United Systems, the Ministry was also able to smoothly integrate the new system with the existing system. For operational convenience Arabic was set as the standard language on all devices and software and Niederhauser concludes by pointing out that this project is just one example of the wider success that TBS is having in the Middle East region.

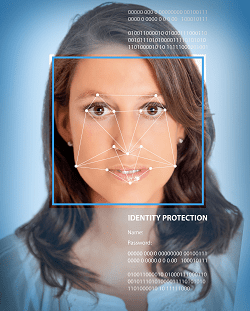

Another area where the footprint of biometrics is expanding fast is facial recognition. At Intersec 2017, for instance, we saw South Korean vendor, Suprema – a leader in biometrics and security – bringing to market what it claims is, for its class, the world’s fastest and most advanced facial recognition technology. During the event Suprema showcased a prototype version of FaceStation 2, the company’s flagship facial recognition terminal.

Suprema confirms that the FaceStation 2 terminal features the latest facial recognition technology to provide the world-beating performance in terms of matching speed, user capacity and operating illuminance. In terms of speed, the new technology is said to perform at an ultra-fast matching speed of 3,000 matches per second. Suprema says that the facial recognition technology has been improved thanks to an enhanced algorithm, new optical structure, and class leading quad-core CPU, so that matching speed has been improved by 300 per cent over its predecessor. On the optical side, the new face recognition technology is designed to overcome possible interference from dynamic lighting conditions including sunlight and ambient light. “Our focus to develop this new technology is to fulfil increasing demand for highly secure biometric authentication in time and attendance applications,” Suprema Director, Hanchul Kim said.

Border control

Regarding the roll-out of biometrics for border control, Acuity Market Intelligence believes that ongoing concerns about national security are driving border authorities to continue to embrace biometric and digital identification based automation.

Acuity reports that there are 2143 Automated Border Control (ABC) eGates and 1436 Automated Passport Control (APC) Kiosks currently deployed at more than 163 ports of entry across the globe and that deployments increased significantly between 2013 to 2016 achieving a combined CAGR of 37 per cent. APC Kiosks reached 75 per cent growth during this period while ABC eGates grew at a more modest 24 per cent CAGR. “As the Trump administration doubles-down on immigration restrictions and promises of ‘extreme vetting,’ the reality is that biometrics are used to scrutinize millions of international travellers across the globe every day,” says Maxine Most, Principal at Acuity Market Intelligence.

The changing face of biometrics

So, to conclude, the message which comes out loud and clear here is that the biometrics landscape is a fast changing one as new technologies are trialled and deployed and existing solutions are refined even further. It will be interesting to see, in the year ahead, which approaches continue to gain traction and which fall by the way side for physical security, online applications, border control, and to support time and attendance. Will facial recognition make in-roads or will it face stiff competition from new fingerprint solutions that bring an added dimension to the table?

[su_button url=”http://www.securitewsdesk.com/newspaper/” target=”blank” style=”flat” background=”#df2027″ color=”#ffffff” size=”10″ radius=”20″ icon=”icon: arrow-circle-right”] For more articles from Security News Desk, click here [/su_button]